GM drive to restore Opel’s image

General Motors will next month launch a campaign to try to restore confidence in its European Opel brand, which was damaged during the lengthy talks with governments and workers about restructuring and state aid.

The programme will include incentives for new and existing customers of Opel – the US carmaker’s European brand that trades in the UK as Vauxhall – and focus on Germany, where it has its headquarters and where the brand’s image has suffered the most.

Nick Reilly, president of GM Europe, told the Financial Times on Friday: “We have to get more people putting Opel on their consideration list, particularly in Germany, but everywhere.”

He said that GM was planning a “confidence campaign” aimed at bringing buyers back to the brand from next month, but declined to give details as he did not want to make them known to competitors.

A person briefed on GM’s plans, who asked not to be named, said the measures would include a “loyalty bonus” for customers who traded in their old Opel for a new one. The incentive for some models could be as high as Germany’s former state-sponsored scrappage incentive, which awarded drivers €2,500 ($3,092).

A second person familiar with GM’s campaign said that, in addition to the loyalty incentive, it would include concessions on pricing and servicing of cars aimed at bringing customers back into showrooms.

GM this week said it was withdrawing applications to several European governments for up to €1.8bn of loans or guarantees for its €3.3bn plan to restructure Opel.

The move came amid an improvement in GM’s financial health and followed a year-and-a-half of tortuous deliberations that generated negative publicity for the carmaker – especially in Germany, where anxiety was highest about Opel’s job cuts and ability to remain solvent.

Jaap Timmer, president of Euroda, Opel’s European dealership association,, said: “Some customers were still in doubt if Opel would survive.” He declined to comment on GM’s upcoming campaign. “It is very important to regain the confidence of customers now.”

Mr Reilly said that GM’s market research showed that the difficulties Opel had gone through was “top of mind” in Germany, but less so in other European countries.

The controversy has had very little impact on Vauxhall’s image in the UK, for example.

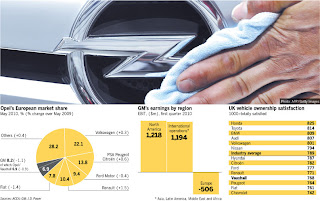

Opel and Vauxhall controlled a 6.9 per cent share of the European car market in May, down from 7.8 per cent a year ago, according to the carmakers’ association Acea.

Analysts said GM faced a tough market this year because of its heavy reliance on Germany and the UK, which together account for about a half of its sales. In both countries, scrappage programmes that last year boosted sales of Opel’s small cars have ended.

GM also faces intense competition in Europe from other mass-market carmakers, including Ford Motor, Hyundai, Toyota, and PSA Peugeot-Citroën. Unlike them, Opel has no significant presence in faster-growing emerging markets such as China and Brazil.

“There has been increased competition in the group that we call non-premiums, especially from the Japanese and the Koreans,” said Jonathon Poskitt, a forecaster with JD Power, the consultancy. “That has hit Opel’s market share in the region.”

In Opel’s favour, it is hitting a stronger period in its model cycle with the launch of models like its new Astra, which accounts for about a third of its sales.

Opel aims to claw back business with an ambitious model ramp-up that will see 80 per cent of its fleet replaced by 2012 and €11bn invested by 2014.

“It will take some time, but I am very confident that we can regain market share,” said Mr Timmer.

Opel’s dealers are placing hope on a new small car due out next year.

Imelda Labbé, Opel’s new German head of sales, presented the first pictures of the minicar at a dealers’ meeting this week, a person who attended it told the FT.

The model, with the working title Opel City, will be a small car targeting younger people and meant to rival Fiat’s 500 and BMW’s Mini small cars.

Dealers expect the car to reach showrooms by the end of 2011.

Analysts said that one of Opel’s biggest challenges would be to catch up with rivals in small-car technology, especially in the small diesel and three-cylinder engines popular in Europe.

“Volkswagen with its model line-up and Fiat with its engine technology performed magically in recent years,” said Christoph Strümer, analyst at IHS Global Insight. “It will take a lot of effort for Opel to make up ground.”

Mr Reilly said that Opel’s forthcoming campaign would include information on its new technology, including electric vehicles.

He said that in addition to the brand’s Ampera battery-powered model due out next year, it planned to launch another two or three electric cars in coming years.

Copyright The Financial Times Limited 2010. You may share using our article tools. Please don't cut articles from FT.com and redistribute by email or post to the web.